17+ property tax proration calculator

Go to IRSgovOrderForms to order current forms instructions and publications. The fees and proceeds are only an estimate and should not be construed as a binding commitment or the actual closing figures.

California Property Taxes Viva Escrow 626 584 9999

Here are the last 10 years of military retirement COLA pay raises.

. In Iowa Kansas North Dakota and Nebraska the fee is 499 per property per week. California voters have now received their mail ballots and the November 8 general election has entered its final stage. Zillow has 26 photos of this 399900 5 beds 2 baths 4500 Square Feet single family home located at 4921 S Prairie Ave Chicago IL 60615 built in 1885.

To figure the proration rate divide the number of days you rented the home at fair rental value by the total days used for both personal and business purposes. Fayette County will begin to accept payments for 2022 Property Taxes on October 1st 2022. When the IRS disallows the writeoffs back taxes as well as interest charges and high penalties must be paid.

Remember to have your propertys Tax ID Number or Parcel Number available when you call. 499 first listing is free All other states. This map was.

Iowa Kansas North Dakota and Nebraska. Sep 12 2022 300 AM. As discussed in prior news items and tax blog the federal government has announced proposals that will require additional reporting for reportable transactions and notifiable transactions Revised legislation for these rules was announced on August 9 2022 see our August 22 2022 update below.

10 hours agobased on data compiled by credible mortgage refinance rates have risen for three key terms and fallen for one other term since last fridayLets take Zillows refinance calculator as a prime. Rental property management rent collection15 points per property. Welcome to Fayette County Property Tax Renewals.

As you can see from this table there have been three years in the last decade 2010 2011 and 2016 in which there was no COLA increaseThe last decade witnessed a low-inflationary period. There is a fee to pay online. Bring your Offers and Bring your Fresh Ideas to finish this 4 Bedroom 2.

Virginia state income tax rates and tax brackets. You can call the Contra Costa County Tax Assessors Office for assistance at 925-313-7400. Simply close the closing date with the drop down box.

Property tax is charged on 80 of rent received from real estate located in Hong Kong at a rate of 15 resulting in an effective rate of 12. Examples of these fees are closing. Today is Tuesday August 2 2022.

If you need help with a Property Tax payment please contact Fayette County at 205-932-6115. Updated April 20 2022. Max manages the operations of XYZ Inc.

Amid rising prices and economic uncertaintyas well as deep partisan divisions over social and political issuesCalifornians are processing a great deal of information to help them choose state constitutional officers and. 999 first listing is free Yes as of May 2022 Zillow charges a rental listing fee of 999 per property per week in most states. ABUSIVE TAX SHELTER limited partnership the IRS believes is claiming illegal tax deductions.

So in order to find the property tax. Rates are subject to change. National income tax rates.

Ordering tax forms instructions and publications. FROM - 112018 TO - 12312018. The current average 30-year fixed mortgage rate climbed 7 basis points from 570 to 577 on Monday Zillow announced.

120 plus 5 of the amount overProperty Tax Changes from the Texas 87th Legislative Session. TurboTax offers limited Audit Support. Closed purchase or sale30 points.

97423 Phone 541396-7725 Fax 541396-1027. Your income tax return is due July 15 2022. Legislation enacted by the General Assembly in 1996 directed that the BPOL Guidelines be updated triennially to provide a current interpretation of Code of Virginia 581-3700 et seqThis edition incorporates the statutory and.

View Klamath County Sheriffs real property sales notices and property listings by sale date property type city notice of sale supporting documents and photos. LifeGreen Preferred Checking With this interest-bearing checking account you can get a Premium Money Market as long as your LifeGreen Preferred Checking account remains open 50 discount on one Safe Deposit Box with an additional 10 discount for auto debit 11 Relationship rates on most CDs for customers who meet the Relationship requirements 12. If you are a fiscal year taxpayer complete the fiscal year information at the top of Form 502 and print FY in bold letters in the upper left hand corner of the formWhenever the term tax year appears in the instructions fiscal year taxpayers should understand the term to mean fiscal year.

The term millage is derived from the Latin word millesimum meaning thousandth with 1 mill being equal to 11000th of a currency unit. Is an eligible employer. GREAT INVESTMENT OPPORTUNITY BRICK BUNGALOW WITH EXPANDED 2 CAR GARAGE SOLD AS-IS 100 TAX PRORATION NO SURVEY NO HARD MONEY LENDERS PROOF OF FUNDS WITH CONTRACT EMD 5 CERTIFIED FUNDS ALARM SYSTEM NOT INCLUDED.

January 1 2000 Enclosed are the 2000 BPOL Guidelines for the Business Professional and Occupational License BPOL Tax. Learn more about the tax rules for renting your vacation home for part of the year from the experts at HR Block. This type of shelter usually inflates the value of purchased property thus providing a basis for higher depreciation write-offs.

The maximum amount you can elect to deduct for most section 179 property including cars trucks and vans you placed in service in tax years beginning in 2021 is 1050000. As used in relation to property tax 1 mill is equal to 1 in property tax. Maxs only remuneration is a semi-annual bonus paid on January 15 and July.

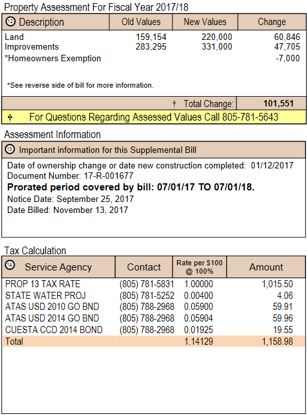

Then enter the local county and school tax amount and enter the tax period ie. 2 of taxable income. An executed lease for a landlord or tenant5 points per transaction.

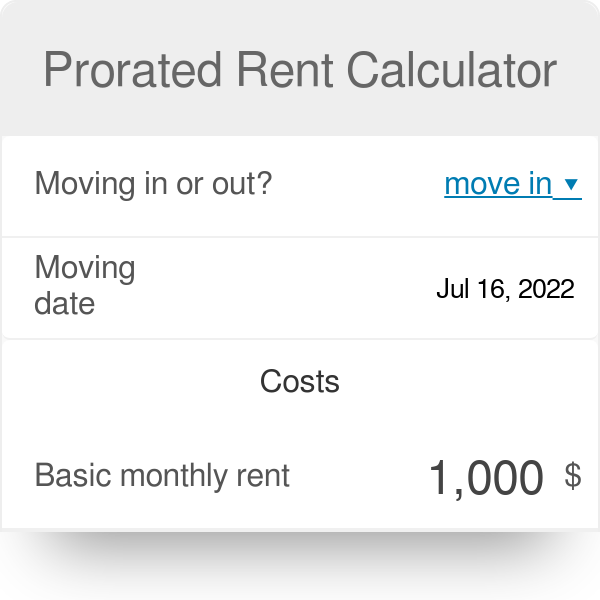

This proration calculator should be useful for annual quarterly and semi-annual property tax proration at settlement calendar fiscal year. 60 plus 3 of the amount over 3000. Compare up to 5 free offers now.

Update on mandatory reporting proposals. Call 800-829-3676 to order prior. Click here for more details.

4855 W School St Chicago IL 60641 is a 1945 sqft 3 bed 2 bath Single-Family Home listed for 189000. And also owns all of the issued shares of the corporation. Annual COLA increases are generally larger in years with higher inflation.

Rental property management rent. Email protected Payments can be made online over the phone mailed or delivered to our office. 225 LESS 25000 Of Net Sale Price.

The following are some of the property tax law changes from the Texas 87th Legislative Session. Proration of the income by reference to the number of days of their services in Hong Kong that is similar to the proration applicable to stock option benefits may. If a bonus was paid in a relevant baseline period a proration will generally be necessary to determine a weekly amount.

Single Family home 169500 3 Bd 2 Ba 3750 Sqft 45Sqft at 11803 S Bishop St Chicago IL 60643. Coos County Tax Department Coos County Courthouse Room 207 250 N. October 6 2022.

The Seller Net Sheet Calculator provides an estimate of the charges costs and fees that may be incurred in the sale of a residential resale property. Farm and Ranch and unimproved land transactions.

Montgomery County Tn

Property Taxes City Of Kitchener

A Big Closing Cost Sometimes Determining Real Estate Tax Prorations At Closing In Illinois Illinois Property Law

What Is Property Tax Proration

How To Compute Real Estate Tax Proration And Tax Credits Illinois

Property Tax Proration Va Guidelines On Va Home Loans

![]()

Prorated Rent Calculator Apartmentguide Com

Prorated Rent Calculator Meaning

Real Estate Math Video 6b Prorate Real Estate Taxes 365 Day Method Real Estate Prep Exam Youtube

Taxes And Closing Pitfalls Texas National Title

The Property Tax Annual Cycle Myticor

How To Calculate Property Tax Prorations Tsre Tampa School Of Real Estate

Prorated Rent Calculator Rentspree Blog

Real Estate Legal Pro Tip Before Signing Contract Carefully Consider Tax Proration Language When Contract Price Exceeds Auditor S Valuation Finney Law Firm

Cv Escrow How Property Tax Prorations Work In Escrow

Tax Prorations Clear To Close

How To Read Your Supplemental Tax Bill County Of San Luis Obispo